I’ve been in the insurance industry for 10 years. I got my AAI, or Accredited Adviser in Insurance within the first 2 years. I strongly believe in furthering my education and pushing myself. Therefore, I immediately started the longest journey of my life: The road to those wonderful 4 letters, CPCU, or Chartered Property Casualty Underwriter designation. It’s been an incredibly humbling experience and I’m constantly asked, “Is it worth it?”

I’m constantly reminded: “You’ve wasted so much time”, or “It has cost you so much money” or even ” No one will care that you have those letters”.

I recognize there is some truth behind these statements. Quite frankly-those nay sayers may be completely right. I may be wasting my time. I may have worked so incredibly hard for a designation no one will truly understand. But at the end of the day, it has been SO WORTH IT. I have learned SO much about the industry, management, finances, and most importantly myself. With each passing grade, I gained more confidence to go up against the most established agents and the largest prospects. I learned that humility is an incredible asset. I learned that encouraging those on the same path is extremely important. I learned that a designation can evolve your entire life, both professional and personal.

But what does the rest of the world think?

Is an Insurance Designation Important to the Consumer?

“When you see the letters CPCU, AAI or CIC behind an insurance professional’s name, does it make you more inclined to do business with them? Do you know what those letters mean?”

When we asked random people this question on social media and on the streets of northern Virginia, 80% of those whom answered were more inclined to do business with an individual displaying letters after their name. “Letters after your name can only be good,” says Bonnie Shindelman of Falls Church, VA. The follow up question, however posed a different result. 100% of those whom answered had no clue what those letters stood for or meant. Think about that…

100% of those interviewed had no clue what those letters meant!

If 100% of consumers haven’t a clue what those hard earned designations mean, is it worth the time and effort? In my opinion-ABSOLUTELY. Take for example, Jess Doddy from Bristol, PA. She said, “If I saw one agent with (a designation), and one without, I would definitely choose the one with. To me, they would seem more knowledgeable and current.” That is EXACTLY what my hypothesis was from the beginning. I don’t personally know what specific industry designations mean, however when I see an accountant with letters behind their name and one without-I’m more inclined to choose the one WITH (unknown) letters. Getting a designation may not mean that particular accountant is more knowledgeable than the next, but it certainly proves he’s a hard worker and willing to put in the extra hours. I’d choose the hard worker over the paper pusher any day. Hard workers become world champs:

Is an Insurance Designation Important to Others Within the Insurance Industry?

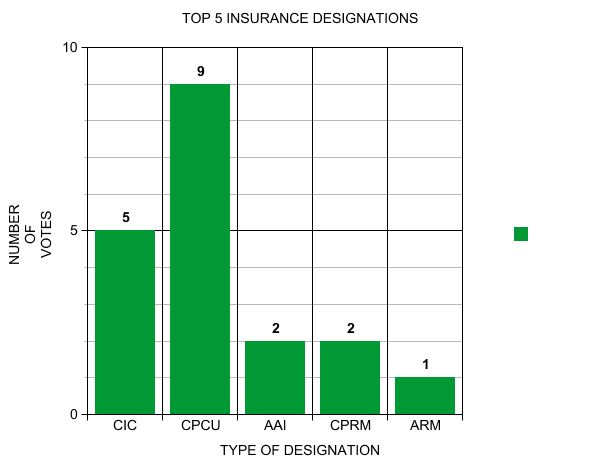

I interviewed fourteen highly respected individuals in the insurance industry. These individuals have either served as a past president to the Independent Insurance Agents and Brokers of America, or currently sit on the Executive Committee of the IIABA. A whopping 72% thought it was considered credible to hold a designation, specifically CIC (certified insurance counselor) or CPCU. Some of these professionals voted for more than one category, but the results were impressive:

Designations Are Not What is Most Important.

What this graph doesn’t show are the 6 “designations aren’t most important” votes. Out of those 6 votes, 3 individuals acknowledged having a designation may make you credible, however had follow up comments to support their initial claim. Spencer Houldin of Ericson Insurance Advisors says,

“I strongly believe that continuing education and constant reading are critical. But, you do not need to obtain a designation to get that knowledge.”

Mike McBride of Mason McBride Insurance Agency in Troy, MI agrees with Houldin.

“My advice is to ignore what other people think and pursue advanced education that is meaningful to you as an individual.”

CPRM, Certified Personal Risk Manager

Furthering this thought, obtaining a designation just for the letters behind your name isn’t enough. There must be a reason behind it. A relatively new designation, CPRM, or Certified Personal Risk Manager is held by past president, Mr. Tom Minkler of Clark Mortenson. He and his wife, Heather, are the first two to receive this designation in his state of New Hampshire. This designation will help him better serve their high net worth personal lines clients. Obtaining a designation that will better serve your niche is a common reason among this class of intellects. Becoming an “expert” in a particular line of business such as how to insure a high end book collection or a rare piece of artwork is an extremely sought after quality to have as a highly respected insurance professional.

ARM, Associate in Risk Management

If you are a client that has no idea who your agent is or only hears from them upon renewal, it’s time to search for a new Trusted Choice agent. Risk management should be the number one service offered to clients. We as agents should be able to prevent losses from happening, providing the companies with the absolute best exposures and our clients with the absolute best rates available. Becoming more knowledgeable in risk management is something 2 of our esteemed panelists believe to be credible and worthwhile.

CIC, Certified Insurance Counselor

The second most credible designation to obtain for an insurance professional according to this elite bunch is the CIC, or Certified Insurance Counselor. John Costello, a current executive committee member of the Big I claims it is the most meaningful.

“It demystifies the technical aspects of the coverage and policy forms and positions you as a professional.”

Minkler sides with Costello and believes his CIC designation is the most credible designation he has.

“The designation prepares me for day-to-day interaction with my clients and prospective clients. It is a practical hands on approach to problem solving and professional recommendations.”

Something worth noting about the CIC is the annual continuing education you must pass in order to maintain this designation. Many in the industry believe this to be the most credible designation solely based off of this renewal obligation. Alex Soto, another past president, thinks the CIC is better recognized than other designations and backs this belief of maintaining CE compliance to be the main factor.

AAI, Accredited Adviser In Insurance

The mention of this designation made me so excited because it is the ONLY designation I currently hold. The reason for the acknowledgement, however, is the same reason why I obtained it. It’s a great way to start your path towards becoming a CPCU. Like the Institutes notes, by passing three tests, you can “establish a clear professional advantage in the marketplace and fulfill your commitment to customer service”.

CPCU, Chartered Property Casualty Underwriter

As suspected, the majority of the panel agreed that having the CPCU designation is the most credible in our industry. In fact, 9 out of 14 highly respected insurance professionals believe this.

Out of those 9 past presidents interviewed, Tom Ahart, our very own principal here at Ahart, Frinzi & Smith points out that,

“Many company CEO’s have the CPCU designation. Those high company executives know just how difficult it is to obtain and are more likely to offer agency appointments to agents who posses the work ethic it takes to pass the series of exams.”

According to a December 2016 CPCU Society Member Survey, three out of five CPCUs strongly believe that their designation gives them credibility. This designation helps agents build the confidence and professionalism they need to rise to the next level. Bob Fee, of Fee Insurance in Kansas believes strongly in the CPCU designation.

“The CPCU designation crosses both company and broker. It allows one to have a good amount of knowledge about insurance company accounting, underwriting, risk selection and legal issues while also allowing insight to an insurance company employee about issues faced on the agency/brokerage side every day.”

Why is the CPCU Designation so Important to Me?

I went to George Mason University (GO PATRIOTS) and majored in International Politics. I worked for a United States Congressman right out of college. Clearly, NONE of this prepared me for the big bad insurance world.

I’m also somewhat of a perfectionist, so not knowing everything right away was incredibly intimidating to me. Going after what many in our industry believe to be the “Masters of Insurance”, was my idea of gaining knowledge and ultimately confidence. College was easy for me. Getting my AAI was pretty painless. How hard could it be to get my CPCU?

Like this.

Constantly running up a flight of steps.

Only…

The flight of steps continues to grow.

And I’m running during an ice storm.

Without shoes on.

I have been trying to get my CPCU designation for five years. You read that correctly. FIVE YEARS! Granted, I have had 2 babies during that time (amazing little boys), but this designation is NO JOKE. As mentioned in the beginning of this article-I have learned so much about the insurance industry, but more importantly, I have learned so much about myself. I knew the laws and regulations test could be passed with my eyes closed, but I never imagined a course like finance could change my life. Sure, I’m a bit dramatic- but seriously.

CPCU 540: “Finance and Accounting for Insurance Professionals” Changed My Life.

I have never in my life failed a test. As embarrassing as this is to admit, I have failed this particular test three times. Three times! After the first attempt, I developed this terrible thing called ANXIETY. While I was completely prepared for the test, I couldn’t relax in the testing center. I tried tapping my pencil. I tried closing my eyes and meditating. I even tried pulling my hair out. Nothing worked. I ran out of time…and failed the test two more times.

CPCU 540 has made me a stronger person. As the reigning Super Bowl MVP states,

“Failure Is a Part of Life.”

(For Nick Foles entire speech, check out USA Today’s post)

I am on track to finally finish this summer. Taking the advice of my amazing husband, I put off this demon test until the very last. I want to throw the biggest party; not just because I finally got my “masters of insurance”. Not just because I will be more credible among my clients and peers. But also because I tackled the greatest educational obstacle I’ve ever encountered.

The Top Five Insurance Designations are listed above. And I’m going to have two of them come this summer.